Best Personal Loan Apps in India

Best Personal Loan Apps in India

Along with the introduction of the smartphone technology, a lot of new business models have cropped up. One of which is the personal loan apps which have been the talk of the town in recent times. With the advantages of being highly customizable and having a great user interface, the loans are easier to apply for and avail. Moreover, with the app having a personalized interface, they are able to cater to devices of different types. This blog will take a look at the applications that have come up and how they can be of use to businesses.

How to find the best personal loan apps?

The market for business loans is heating up with the increasing number of entrepreneurs who are looking for the best loan options available. There are many loan applications available to choose from, but it's important to know which one will be the best for you and your business. In order to find the best loan apps, you need to know the type of app you need. The best loan app is one that will be able to match your financial needs, which is why it is important to know the type of application you want. You can choose from many different types of loan applications, but the most common is a personal loan. A personal loan is an app that helps you to shop around and find the best loan for your purpose. These apps usually offer easy and safe access to loans, which means you'll be able to have a loan within a limited time.

How do these personal loan apps work?

Personal loan apps in India are growing in popularity, and as a result, many businesses are looking to jump on-board and offer these services to their consumers. With the combination of apps and mobile technology, businesses are now able to provide better customer service and a more personal experience. In order to provide you with the best services, Android app development companies with a strong focus on personal loans are now able to offer customized apps to businesses. When it comes to personal loans in India, there are two types of loans that are commonly used: the secured personal loan and unsecured personal loan. The secured loan is a loan that is taken out against a solid asset, such as a Home, Car or Jewellery. The unsecured loan is a loan that is taken out against a loan or credit card debt. These apps are able to provide you with the best service and the best results by offering you a customized service that is specific to your needs.

What are the pros and cons of using these personal loan apps?

For business owners, Personal Loan apps have become more popular in this age of technology. These apps have given their business owners an edge over other competitors by providing them with the necessary information in an extremely efficient manner. When the business owner is able to provide their customers with instant information, they are able to get a better response and provide better service to their customers. However, these apps have their cons as well. First of all, these apps are expensive. This is due to the fact that these apps are customized by the business owner themselves. Furthermore, these apps are also very time-consuming. It is important to remember that time is money. Finally, these apps require lots of maintenance. The app needs to be constantly updated to make sure that it can provide its services in a better way to its customer.

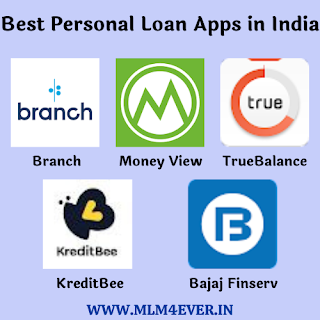

What are the top 5 personal loan apps?

Personal loan apps are a great way to explore your market and establish your brand. However, it is not a good idea to launch too many apps, as it can confuse your customers and make it difficult to promote. In order to give yourself the best chance of success, you should launch just one or two personal loan apps that are tailored to your market. This will allow you to stand out from your competition and give you a greater chance of making a sale. Here are the top 5 personal loan apps, to help you decide which one to invest in.

Branch Personal Loan App:

With apps like Branch, businesses can now provide personal loans to their customers. These apps have made it easier for buyers to get loans with higher interest rates. The app also provides borrowers with a transparent loan process, as well as various features such as loan alerts, easy repayment, and data security. To be able to use the app, a business must have a bank account with a branch of a bank. For those who don’t have a bank account, they can still use bank transfers to make payments. Branch is a personal loan app created by tech firm iMoney. This app is specifically designed for businesses to provide personal loans to their customers.

Money View Personal Loan App:

Money View is a personal loan app where you can apply for a loan, and get the money in your bank account in as little as 24 hours. This app has been in the market since 2013, and their return rate has been seen to be one of the highest in the world. A personal loan app is a good option for those who want to setup their business with a loan. The app is easy to use, and has been developed with mobile banking in mind.

TrueBalance Personal Loan App:

TrueBalance personal loan app is one of the most popular app for business owners in India. With this app, you can receive instant loans and help your business grow. It helps you to manage your bookkeeping, from making payments to business loans, credit cards, and more. It also helps you to manage your personal finances by managing your expenses and bills. This app helps you to track your expenses and bills, and helps you to earn and save more. You can also take an instant loan right from your app. You can also set up auto-payments or set up a bank to be automatically billed without the need to fill up paperwork.

KreditBee Personal Loan App:

The KreditBee personal loan app is a great example of the power of mobile apps. With this app, you can access a personal loan without having to leave your home or office. This app is for those who need quick cash for emergency purposes, home repairs, medical emergencies, and more. It has a simple, straightforward and easy-to-use interface that makes the whole process quick and hassle-free. The app is available for Android users in the U.S., Canada, the UK, Australia and India, and provides various loan options including a personal loan, a car loan and a home loan.

Bajaj Finserv Personal Loan App:

Bajaj Finserv personal loan app is one of the best apps for personal loans in India. This app provides the best customer service and is effective for both personal and business loans. The app is used for quick loan approval, hassle-free loan application, easy loan disbursement and process, cashless repayments, and more. It is a mobile app that is available for both android and iphone users. The app is user-friendly and easy to use, and is available in both Hindi and English.

Conclusion:

This blog post is a list of the various personal loan apps available for businesses in India. These apps are available for businesses and individuals for various loans. The apps provide a personalized loan application and customer care service for their users. Ultimately, these apps allow their users to get loans cheaper and faster and reduce the need for a physical presence.

Related Articles:All About Cryptocurrency in India [2024]

How To Promote Your Business

Telegram Channel Link List

No comments :

Post a Comment

Thanks for Commenting ! Please do not use spam words.